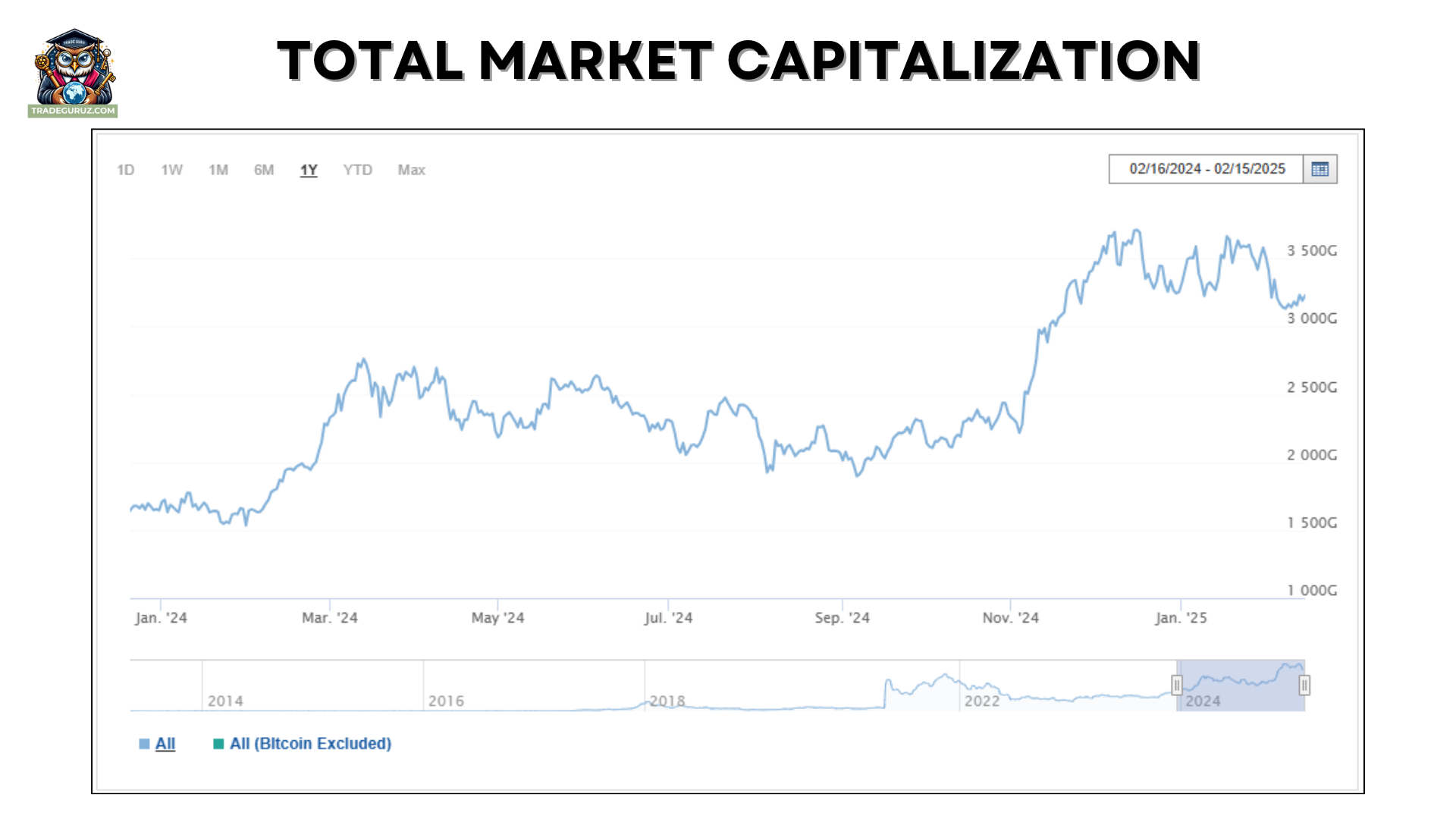

When entering the crypto world, you may have encountered the term “market cap.” Whether you are interested in cryptocurrencies as a professional investor or an enthusiast, understanding the factors that shape this emerging industry can help you make informed investment decisions. So, what is market capitalization? Which coins are dominating the market in terms of capitalization? Let’s dive into and clarify these questions in the article below to gain a more comprehensive view of the crypto market.

Crypto market cap, or market capitalization, is the total value of all the coins that have already been mined. It is calculated by multiplying the current price of a cryptocurrency by its circulating supply.

The market value of a cryptocurrency plays a crucial role in evaluating its stability. Large-cap cryptocurrencies are generally considered stable due to their large trading volume and better risk diversification. Conversely, small-cap coins may have significant growth potential but carry higher risks due to market volatility. By analyzing market capitalization, investors can quickly assess the relative value of a cryptocurrency compared to others instead of focusing solely on its price.

The market capitalization of a cryptocurrency is determined using the following formula:

Market Capitalization = Price x Circulating Supply

For a clearer understanding, consider the example of Bitcoin. At the time of writing:

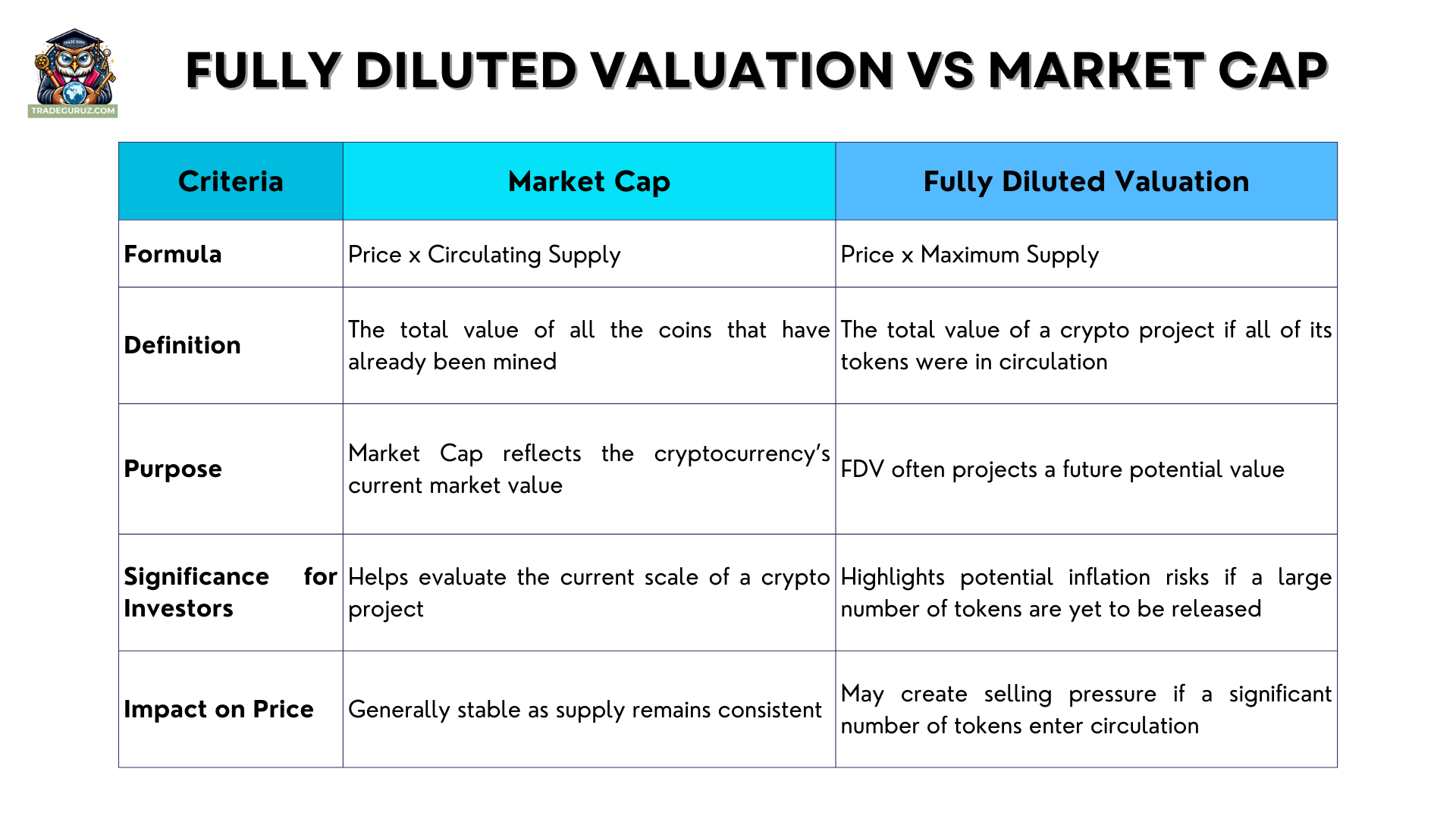

Newcomers to the crypto market often confuse Market Cap with Fully Diluted Valuation (FDV). While both metrics are related, they reflect different aspects of a cryptocurrency’s valuation.

FDV represents the total value of a crypto project if all of its tokens were in circulation, offering a forward-looking view of the project's potential market value. It is calculated by multiplying the token price by the maximum supply.

FDV= Price x Maximum Supply

For example, in the case of Bitcoin:

For coins with nearly all of their supply already in circulation, Market Capitalization, and FDV are relatively close. However, for newer altcoins with a large number of tokens yet to be released, FDV can be substantially higher than the Market Cap. This gap indicates inflation risks, as a sudden influx of new tokens into circulation could impact the asset’s price and overall market value.

Market capitalization not only helps assess a cryptocurrency's value but also serves as a basis for categorizing digital assets. In the crypto market, coins and tokens are typically divided into three main groups: Large-cap, Mid-cap, and Small-cap. Each category has unique characteristics, benefits, and risks that investors should carefully consider before making investment decisions.

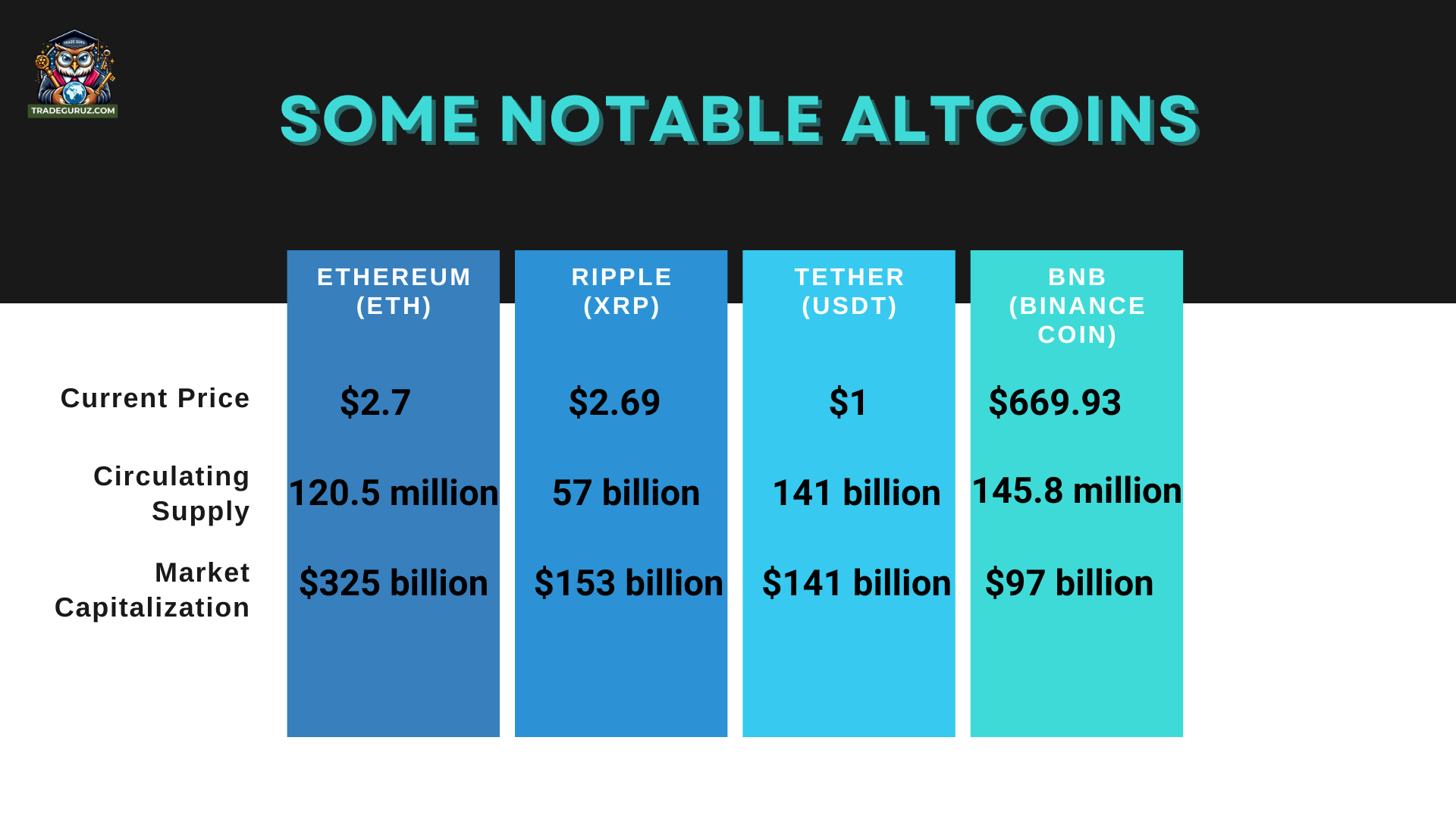

Large-cap cryptocurrencies include coins with a market capitalization greater than $10 billion. These are well-established projects with strong market positions, widespread recognition, and robust ecosystems. Large-cap coins have high liquidity as they are actively traded and less susceptible to price manipulation. Additionally, due to their long development history, these assets generally exhibit lower volatility than mid-cap and small-cap cryptocurrencies. Some of the most prominent large-cap coins such as Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Ripple (XRP).

Mid-cap cryptocurrencies have a market capitalization ranging between $1 billion and $10 billion. These projects are often emerging blockchain networks or DeFi platforms with strong expansion prospects but have yet to reach the scale of large-cap assets. Notable mid-cap coins such as Polygon (MATIC), Internet Computer (ICP), Avalanche (AVAX), and Chainlink (LINK).

While they provide higher profit potential than large-cap coins, mid-cap assets are more volatile and pose greater risks. Investors seeking a balance between stability and growth may find mid-cap cryptocurrencies appealing.

The small-cap group includes coins with a market capitalization of less than $1 billion. These projects are typically newer and less established, making them highly volatile and prone to price manipulation. While some may offer explosive growth, the risk of failure is high. Some examples of small-cap coins like Decentraland (MANA), Basic Attention Token (BAT), and Ravencoin (RVN).

Market capitalization helps determine the true scale of a cryptocurrency rather than just focusing on its price. For example, a coin priced at $1 with 10 billion coins in circulation has a market cap of $10 billion. Meanwhile, another coin priced at $500 but with only 1 million coins in circulation would be just $500 million. This illustrates why it is a more reliable indicator of a coin’s strength and stability than price alone.

This indicator also allows investors to gauge a coin’s growth prospects. Small-cap cryptocurrencies may deliver high returns if the project succeeds, whereas large-cap coins tend to grow at a slower but more stable rate. For instance, Bitcoin currently has a market cap of over $1.9 trillion, meaning it would take a huge amount of capital to double its total valuation. In contrast, Solana (SOL) had a market cap of just a few billion dollars in 2021 but later surged to over $96 billion, ranking among the top blockchain networks. With high growth potential comes higher risk; however, smaller projects may fail or disappear from the market.

Liquidity represents the ability of a coin to be bought and sold on the market. Large-cap coins generally have high trading volumes, making it easier to trade without significantly impacting prices. Conversely, small-cap coins often have low liquidity, making them vulnerable to price manipulation and slippage. For example, trading a large amount of Bitcoin does not substantially affect its market price, whereas a single large buy or sell order in a small-cap coin could cause extreme price fluctuations.

One of the key applications of market capitalization is helping investors compare projects in the same field. For instance, if you are looking to invest in Layer 1 blockchain networks, you can compare the market caps of Solana (SOL), Avalanche (AVAX), and Polkadot (DOT) to determine which project has a stronger market presence. Similarly, if you are interested in stablecoins, comparing the market caps of USDT, USDC, and DAI can provide insights into their relative popularity. This approach enables investors to make more informed decisions rather than relying on intuition or price alone.

Based on the above formula, it is clear that the market cap is directly proportional to both the circulating supply and the price of a cryptocurrency. Consequently, any changes in price or supply can significantly impact this indicator. However, in addition to these two fundamental factors, market capitalization is also shaped by investor sentiment, trading volume, and other key market dynamics. Let’s take a closer look at these factors in the section below.

The total supply of a cryptocurrency is a key determinant of its market capitalization. This supply comprises both the coins already issued and those scheduled for future release. Cryptocurrencies with a fixed maximum supply, such as Bitcoin (21 million BTC), tend to retain value over the long term due to their scarcity. On the contrary, coins with an unlimited supply or those that can issue new tokens as needed may struggle to maintain value. If supply rapidly increases while demand remains unchanged, the price per coin and total market value can decline.

A coin’s price is another critical factor that impacts market capitalization. When prices surge, capitalization rises accordingly. Even minor price fluctuations can cause noticeable shifts in the total market value. For instance, if the circulating supply remains unchanged and a token’s price increases from $100 to $120, its market capitalization will rise proportionally.

Investor sentiment sharply influences cryptocurrency prices, indirectly affecting market capitalization. Positive news such as leading institutional support or major technological upgrades can drive investor interest, increasing demand and boosting prices. On the other hand, negative events, like tightening government policies, security breaches, or the collapse of a major exchange, can shake investor confidence, causing prices to plummet and reducing overall market capitalization.

A coin’s trading volume reflects how frequently it is bought and sold. Higher trading volumes generally indicate greater liquidity and a more active market, which helps stabilize market capitalization. In contrast, low trading volumes suggest weak demand, making prices more susceptible to manipulation and leading to an unstable market cap. When liquidity is low, large buy or sell orders can cause significant price swings, making market capitalization highly volatile.

Bitcoin remains the world's largest cryptocurrency by market capitalization with over $1.9 trillion. Invented in 2008 by Satoshi Nakamoto, Bitcoin has revolutionized how the world perceives digital transactions and currency. With a limited supply of 21 million BTC, Bitcoin is often referred to as "digital gold" due to its store-of-value properties and hedge against inflation.

>> You may be interested in The Ultimate Guide to Analyzing Bitcoin Prices

Beyond Bitcoin, several altcoins also boast large market capitalizations and play significant roles within the crypto ecosystem. Below are some of the most notable altcoins by market cap today.

Market cap is more than just a measure of a coin’s size; it also reflects its strength and stability within the cryptocurrency market. For investors, this metric provides valuable insights into a coin’s adoption level and overall market presence. Capitalization is only part of the overall picture; however, investors should conduct thorough research, stay updated on industry trends, and continuously enhance their financial knowledge to make well-informed investment decisions.

Thank you for taking the time to follow the entire article.

For any inquiries, feel free to contact us at TRADEGURUZ.