Making profits has never been easier, especially opportunities available globally as long as your activities are within the bounds of the law. Global investments are profitable when you choose a reputable trading platform. You are more likely to achieve significant profits if you select the right exchange and thoroughly understand how it works. If you are considering embarking on your investment journey, FxPro is undoubtedly a name that deserves attention. This platform offers powerful tools with various products and markets, prioritizing optimal security and smooth experience. Let's dig into the outstanding features of it through the following FxPro review.

Founded in 2006 and headquartered in London, FxPro affirmed its name as a leading forex broker globally. With nearly 20 years of experience in the financial industry, FxPro has successfully executed over 635 million orders, demonstrating its outstanding speed and accuracy. The broker hosts a diverse portfolio of more than 2.100 products, catering to the needs of traders at all experience levels, making it an ideal choice for both beginners and seasoned investors. FxPro serves over 2 million users from over 170 countries, standing out for its global presence and industry recognition, with over 121 prestigious awards from leading financial institutions. In particular, with a transaction speed of up to 7.000 orders per second, FxPro has proven its ability to deliver lightning-fast execution, ensuring a seamless and efficient user experience.

FxPro makes a strong impression on traders with its diverse range of trading platforms, allowing investors to easily select the one that best aligns with their strategies and trading preferences.

MetaTrader 4, commonly known as MT4, is the most popular trading platform in the financial industry. Its key strength lies in its balance between an intuitive interface and robust performance, making it ideal for both novice and experienced traders.

Key features:

MT5 is an upgraded version of MT4. With multi-asset trading capabilities, such as stocks, commodities, indices, and cryptocurrencies, MT5 functions as a versatile platform to cater to the needs of diverse traders.

Key features:

CTrader is a platform designed for traders who prioritize speed and transparency. With ECN technology, cTrader ensures fast trade execution while providing access to DoM (Depth of Market).

Key Features:

This is FxPro's proprietary trading platform, which works seamlessly on both desktop and mobile devices. It enables users to trade multiple assets within a unified interface without installing third-party applications.

Key Features:

Spread is the most common fee traders incur when executing trades. It represents the difference between the buy and sell price of a currency pair, stock, or other financial instrument. FxPro delivers both variable and fixed spreads, based on the various account categories and platforms.

FxPro does not charge deposit fees for payment methods such as bank transfers, credit cards, or e-wallets; however, certain payment methods may incur fees from third parties. In comparison, withdrawal fees apply depending on the withdrawal method and transaction amount.

When holding a position overnight, FxPro charges swap fees based on the position type. This fee can be positive or negative, subject to market conditions and the interest rates in the relevant countries. FxPro swaps are applied daily from Monday to Friday at 23:59 server time. On Fridays, the fee is tripled to account for the weekend.

FxPro imposes a commission for each executed trade. This fee is determined based on trading volume and varies depending on the market and asset class.

FxPro offers a comprehensive selection of trading opportunities across multiple financial markets. Here is an overview of products on this trading platform, helping you choose the tools that align with your investment strategy.

Futures Contracts: The broker provides access to more than 21 futures contracts, covering various commodities such as coffee, cotton, cocoa, gas, and more.

Indices: Users can trade 24 spot market indices including popular indices from Europe, America, and Asia.

Stocks: FxPro allows users to trade over 2122 stocks from over 150 global companies such as Apple, Google, Amazon, Tesla, etc.

Metals: FxPro supports CFD trading for 8 precious metals including gold, silver, platinum, and their variants.

Forex: As the largest and most popular trading market, FxPro delivers opportunities to trade over 70 currency pairs, covering major and minor pairs.

Cryptocurrencies: Users can trade CFDs on popular cryptocurrencies such as Bitcoin, Litecoin, Ethereum, etc.

Energy: The platform offers three major energy types on the spot market, including Brent oil, natural gas (NAT.GAS), and WTI.

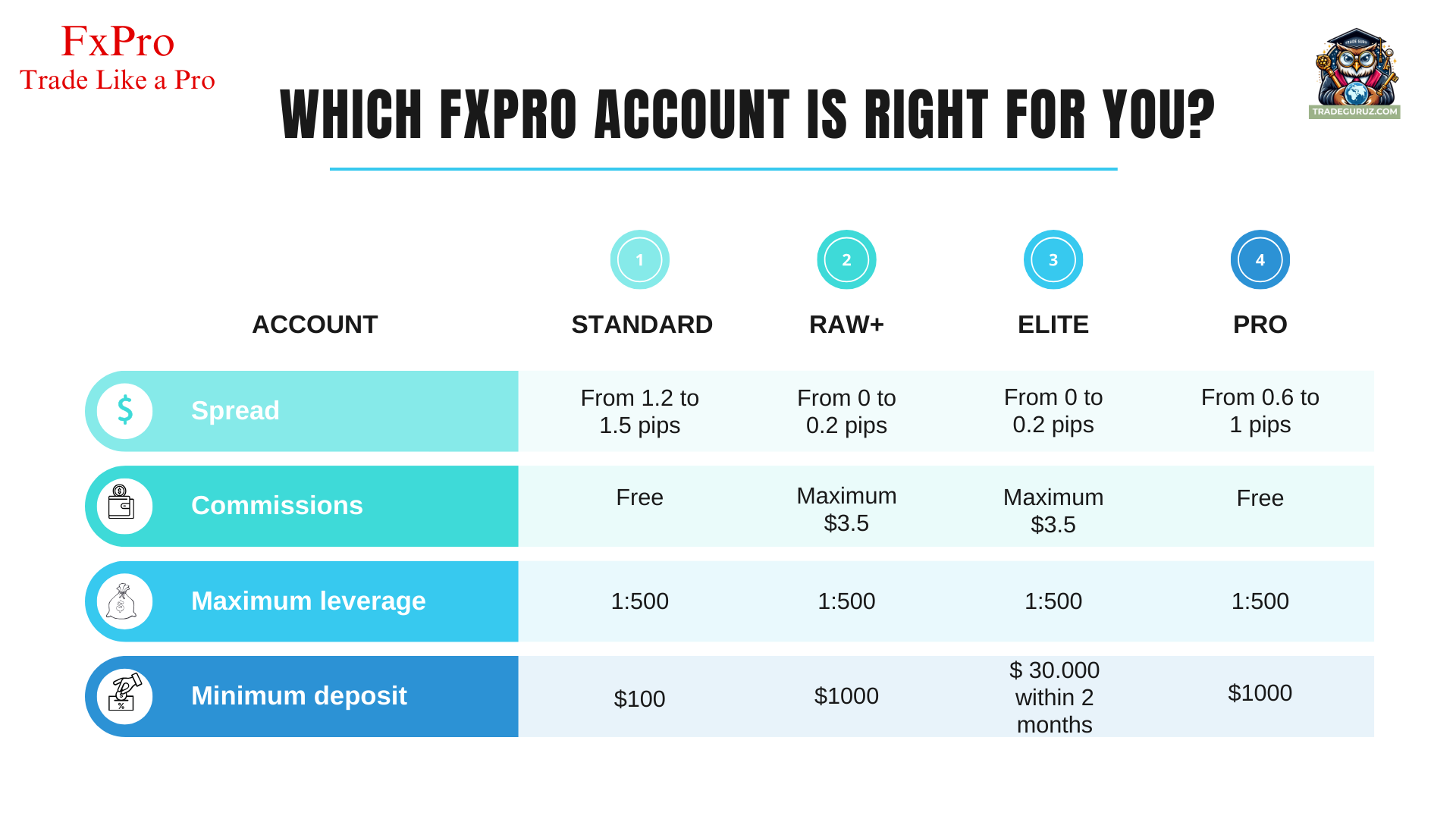

FxPro owns various account types, catering to diverse trading preferences and experience levels. Each account is designed to present unique advantages depending on the trader’s goals and expertise.

Standard account: This is the most popular and easy-to-use account type, suitable for newcomers who wish to easily access the market without worrying about commission fees.

Raw+ account: This account provides competitive spreads to optimize profits, designed for experienced traders with high trading frequency.

Elite account: Elite account is tailored for VIP traders, offering special perks and premium benefits.

Pro account: Pro accounts deliver advanced tools and features to facilitate complex trading strategies.

FxPro is proud to host a diverse portfolio of over 2.100 investment products across seven markets: Forex, stocks, indices, precious metals, cryptocurrencies, energy, and contracts futures. This diversity enables investors to build a flexible portfolio and easily access global markets. FxPro offers a range of trading platforms, including MT4, MT5, cTrader, and the proprietary FxPro Edge platform. With intuitive interfaces, seamless navigation, and superior order execution speed, FxPro is committed to presenting maximum satisfaction and optimal trading space for users.

Customer service partially reflects an organization's professionalism. FxPro delivers top-tier support with multilingual professional teams available around the clock via multiple channels such as live chat, email, and phone. FxPro's reputation is reinforced by positive reviews on independent platforms. On Trustpilot, the broker has achieved 4.7/5 stars from over 2.000 positive reviews, demonstrating global user satisfaction.

One of the most crucial factors to evaluate the reliability of a broker is the certifications from reputable regulatory agencies. FxPro is licensed by leading financial organizations such as FCA (UK), CySEC (Cyprus), FSCA (South Africa), and SCB (Bahamas), ensuring compliance with international standards of transparency and safety. Among these, the licenses from FCA and CySEC are the most valuable, as they require the platform to adhere to rigorous standards, including a minimum capital of up to 1 million pounds according to FCA regulations. Achieving these licenses has contributed to reinforcing FxPro's transparency and reliability. In case of any issues or suspicions of fraudulent activity, users can contact these authorities directly to arbitrate issues and protect their interests. This is a reliable layer of protection, giving you greater peace of mind when trading on FxPro.

Establishing a transparent and trustworthy trading platform has always been FxPro's top priority. FxPro has implemented the highest safety standards for its clients' funds. All user accounts are completely segregated from corporate accounts and stored in leading banks such as Barclays, RBS, and CitiBank. In particular, FxPro is a member of the Investor Compensation Fund (ICF), providing insurance of up to €20,000 in the event of unforeseen circumstances. These robust measures ensure the safety of user funds and reaffirm FxPro’s global reputation as a trusted broker.

According to the FxPro review, the broker stands out with its advanced trading technology and rapid order execution speed, allowing traders to capitalize on market opportunities fully. The platform utilizes powerful servers and direct connections to major financial markets, ensuring orders are executed with minimal latency. With the ability to match more than 7,000 orders per second, FxPro has affirmed its position as one of the highest-performing trading platforms. Additionally, over 80% of trades at FxPro are completed within just 14 milliseconds, minimizing slippage risk and guaranteeing accuracy in each transaction.

Phishing emails are a common tactic that fraudsters use to obtain personal information by posing as a reputable company. To protect yourself, always be cautious and follow these important guidelines:

Malware and viruses can transmit information from your device or change transaction details to steal your identity or funds. Therefore, never download files or programs from untrusted sources. Install anti-malware software on all devices you use and ensure it is regularly updated.

Never share your password or sensitive data with anyone. Be cautious of any contact requesting you to provide account details or personal information like your ID.

Weak passwords are a primary reason why your accounts are vulnerable to attacks. Regularly update your password and use a strong combination of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable information such as family names, date of birth, or nicknames. Do not forget to use different passwords for each website and enable multi-factor authentication whenever possible to maximize account security.

To ensure a secure trading experience, keep in mind that FxPro DOES NOT:

FxPro is a reputable broker recognized by numerous users around the world. With an intuitive interface, advanced technology, and strict account protection measures, FxPro is an ideal start for those who desire to thrive in the financial world. No matter if you are beginning with small trades or looking to build larger strategies, let FxPro accompany you on this journey. Register for an account NOW to experience a professional trading space.

Finally, we hope this comprehensive FxPro review will give you an in-depth understanding of the platform’s features and characteristics, and then make the right decisions. For more detailed information, please contact us at TRADEGURUZ.