As the world of digital assets continues to grow, protecting your cryptocurrencies is more important than ever. A crypto wallet is essential for securely storing and managing your digital assets. However, with countless options available, how do you choose the right one? Do not worry! This article will guide you through the crucial factors to consider when selecting a cryptocurrency wallet. Plus, we will introduce you to the top five best wallets you can rely on in 2025.

A crypto wallet is an application or hardware device used to store digital assets. It acts as a bridge between users and the blockchain network, allowing for secure storage, sending, and receiving of cryptocurrencies. Unlike traditional wallets, a crypto wallet does not hold physical money but stores the private keys that grant access to your digital assets on the blockchain.

Beyond storing cryptocurrencies, crypto wallets unlock various features within the blockchain ecosystem. You can use them to make quick transactions, access decentralized finance (DeFi) platforms, trade NFTs, or participate in staking to earn rewards.

Many people assume that a crypto wallet stores digital currencies like a physical wallet holds cash, but that is not true. Cryptocurrencies always remain on the blockchain - a decentralized ledger that records all transactions. The wallet merely serves as a tool that enables users to access and control their funds through public and private keys. When someone sends crypto to your wallet, no actual coins are transferred, what they are doing is just signing off ownership thereof to your wallet’s address. That is to say, they confirm that the digital assets now no longer belong to their address, but yours. Two digital codes are necessary for this process: Public and Private Key.

By combining public and private keys, crypto wallets ensure secure transactions while maintaining asset integrity. When you send or receive crypto, the system verifies that the wallet’s public key matches the private key to guarantee legitimate ownership. Once verified, the wallet balance updates accordingly.

Crypto wallets can be categorized into two main types: hot and cold wallets, each catering to diverse needs and security levels.

Hot wallets are always connected to the internet and store private keys online, allowing users to easily send, receive, and manage digital assets. When making a transaction, the wallet authenticates using the private key and broadcasts the transaction to the blockchain for confirmation. While this setup enables fast transactions, it also introduces potential security risks.

- The biggest advantage of a hot wallet is its high convenience. Your public and private keys are stored and encrypted within the wallet application or website, allowing access to your funds from anywhere with an internet connection, as long as they are not limited to a specific device.

- It is easier to recover access if you lose access to your private key than with a cold wallet.

- Hot wallets support multiple blockchain networks and integrate with DeFi, NFTs, and decentralized applications (dApps).

- Hot wallets are always accessible online, they also face a greater risk of cyberattacks. Hackers can exploit hidden vulnerabilities in the wallet software or use malware to break into the system.

- If your internet connection is unstable, your ability to make transactions may be affected.

- With a custodial wallet, the exchange holds your private keys, so if it gets hacked or shuts down, you could lose your funds.

Cold wallets store private keys completely offline on a piece of hardware or sheet of paper. To make a transaction, users must connect the wallet to a device to sign and broadcast it to the blockchain. Hardware wallets usually come in the form of a USB drive which lets you buy, sell, and trade crypto when it is connected to a computer. With a paper wallet, you can access your keys via a QR code printed out, written on a piece of paper, or engraved on some other durable material like metal.

- Cold wallets stand out with their robust security. Since it is not connected to the internet, they are immune to cyberattacks, including hacking, viruses, and malware. Even if your computer or phone is infected, your cryptocurrency remains safe because your private key stays offline.

- Take full control of your assets because you are the only one who owns the private key.

- Cold wallets operate independently, unaffected by exchange attacks or technical problems. As long as you carefully keep your wallet and implement backup methods like seed phrases, your assets are always safe no matter what happens to the trading platform.

- Transactions take longer on average. Each time you want to send funds, you need to connect the wallet to a computer or mobile device for authentication, which can be inconvenient for frequent traders.

- Difficult to recover lost funds. If you lose your private key or seed phrase without a backup, recovering your assets is nearly impossible.

Before choosing a wallet, it is important to understand why you are looking for a cryptocurrency wallet in the first place. The best wallet for you depends on your specific needs, so ask yourself the following questions to determine exactly what you require:

Once you have answered these questions, you can move on to the next section to explore the key factors to consider when selecting a crypto wallet.

Whether you are a seasoned trader or a beginner, an accessible and intuitive interface is always a plus. Look for wallets with easy navigation and clear instructions. The best wallets should not require complicated steps just to make basic transactions. Additionally, multi-platform support such as mobile apps, web browsers, and desktop software adds flexibility, enabling you to manage your wallet anytime, anywhere.

The ability to store diverse cryptocurrencies is a huge advantage. The general rule for compatible assets is "the more, the better." Some wallets only support Bitcoin and Ethereum, while multi-chain wallets can store various digital assets across multiple blockchains. Your chosen wallet should be compatible with the cryptocurrencies you wish to trade and will ideally accommodate any other coins you may want to invest in the future.

Many crypto investors do more than buy and sell, they also participate in the decentralized finance (DeFi) ecosystem to maximize profits. Some wallets directly connect to DeFi platforms, allowing users to lend, borrow, or provide liquidity effortlessly. If you are interested in NFTs, be sure the wallet supports secure and convenient storage and trading of NFTs. Additionally, staking is an important feature that enables you to earn passive income by locking tokens to receive rewards. Choosing a wallet that fully supports these features will help you maximize your cryptocurrency’s potential.

Security is the most crucial factor when selecting a cryptocurrency wallet. Look for wallets with two-factor authentication (2FA), PIN codes, biometric authentication (fingerprint or facial recognition), and multi-signature transactions to reduce the risk of asset theft. Be sure the wallet offers backup options such as seed phrases or recovery tools. In addition, private key control is also important. Some non-custodial wallets give users full control over their private keys, while custodial wallets store them on the provider's servers. If security is your top priority, opt for a wallet that allows you to manage your private keys to ensure your assets are always under your control.

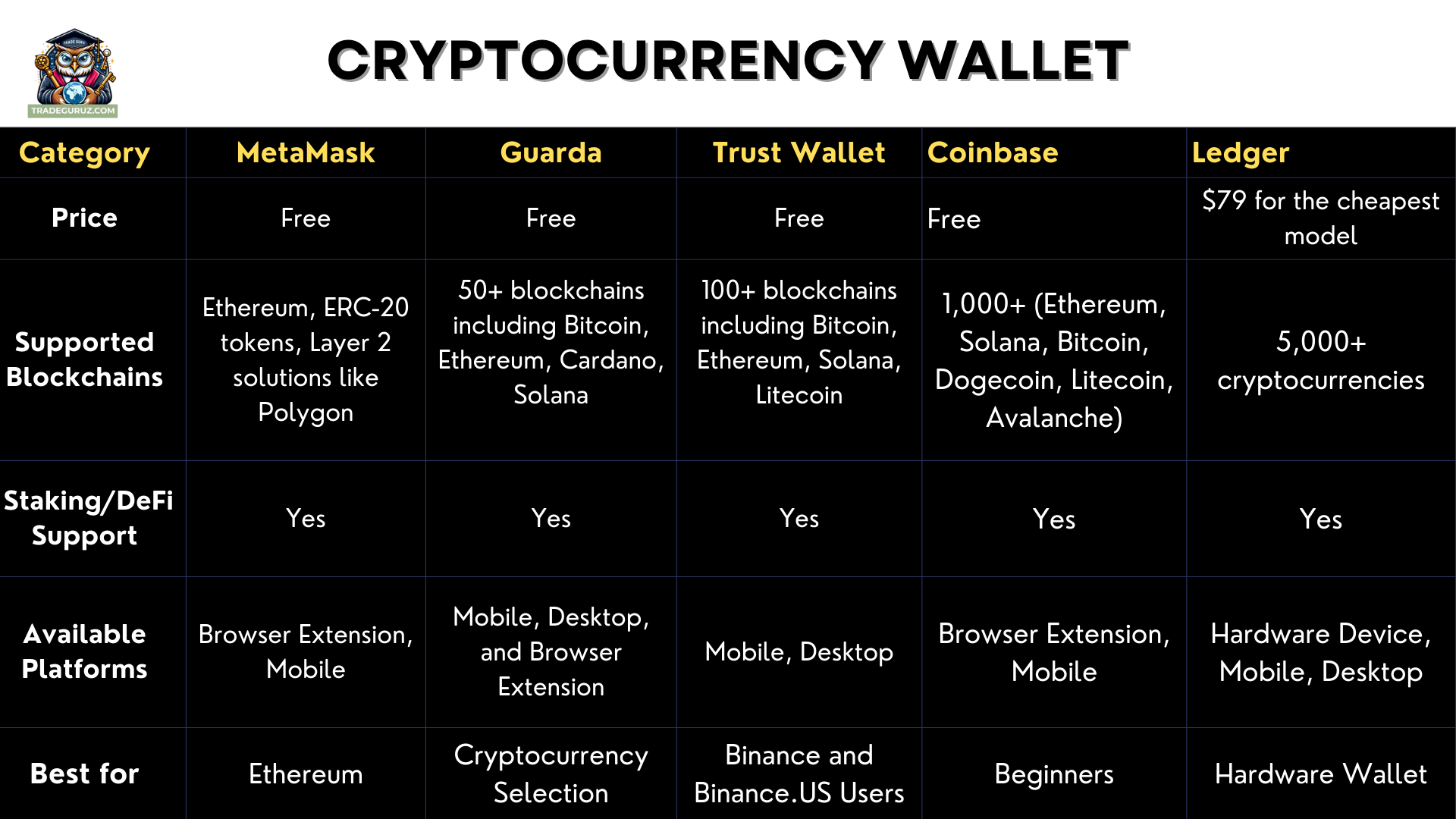

MetaMask was launched in 2016 by ConsenSys, a leading blockchain software company. It is the go-to wallet for Ethereum enthusiasts and anyone involved in DeFi or NFTs. As one of the most widely used hot wallets today, MetaMask boasts over 30 million active monthly users. Its key advantage lies in seamless integration with decentralized finance platforms, enabling users to easily engage in token swaps, staking, and liquidity mining with just a few clicks. However, if you are not an Ethereum enthusiast and its related tokens, MetaMask might not be much help to you.

Guarda was introduced in 2017 by a team of blockchain experts to deliver a multi-platform wallet solution. It is a non-custodial crypto wallet that supports over 400,000 assets across multiple blockchains. It is available on desktop, mobile, and as a browser extension, making it extremely versatile. Besides, Guarda also integrates with Ledger for cold storage and offers staking options, however, the built-in transaction fees are quite high at 3.5%.

Founded in the same year as Guarda, Trust Wallet was created by Viktor Radchenko as a mobile-first cryptocurrency wallet designed for storing various cryptocurrencies. It gained rapid popularity due to its ease of use, multi-chain compatibility, and strong focus on security. In 2018, the giant Binance acquired Trust Wallet, making it the official wallet within its ecosystem. Despite its links to Binance, Trust Wallet both maintained its decentralization and expanded its functionality for DeFi, NFTs, and staking, giving users more opportunities to earn profits from their crypto assets. Trust Wallet is prominent with its extensive asset compatibility, supporting over 10 million digital assets across over 100 blockchains - the largest number on our list.

As its name suggests, Coinbase Wallet was launched in 2018 by Coinbase - one of the world’s largest cryptocurrency exchanges. Unlike a Coinbase exchange account, Coinbase Wallet is a non-custodial wallet, meaning you have full control over your private keys. This wallet is an ideal choice for newcomers to the crypto market due to its intuitive and user-friendly interface. It also offers seamless integration with the Coinbase exchange and access to DeFi protocols. However, Coinbase Wallet only supports eight blockchains, which might be a limitation for some users.

Founded in 2014 in France by a team of security and blockchain specialists, Ledger set out to create the most secure cryptocurrency storage solution. The company developed the Ledger Nano series, with the Ledger Nano S and Ledger Nano X becoming two of the most popular and safest cold wallets on the market. Ledger hosts over 5,000 cryptocurrencies and can integrate with software wallets like MetaMask and Guarda. It stands out for using a Secure Element component - a type of chip commonly seen on passports, credit cards, and payment systems to add an extra layer of security to the wallet, preventing potential attacks.

Founded in 2017 by Changpeng Zhao (CZ), Binance quickly became the world’s largest cryptocurrency exchange by trading volume. It boasts a vast ecosystem including Binance Futures, Binance Earn, Binance NFT, etc. with hundreds of trading pairs and digital assets.

Pros:

- Delivers a diverse portfolio of cryptocurrencies, with over 1,000 digital assets available.

- Low trading fees, starting at just 0.1% for spot trades. Additionally, users who pay fees using BNB can receive discounts of up to 25%.

- Robust security system with two-factor authentication (2FA) via Google Authenticator or SMS. Binance has also established the SAFU Fund to protect users in the event of a security incident.

Cons:

- Faces legal challenges in certain countries.

- Servers may experience performance issues during periods of high traffic.

Established in 2018, Bitget stands out for its derivative products, especially copy trading. The exchange has rapidly expanded its market presence through strategic partnerships with various KOLs and major sports teams.

Pros:

- User-friendly interface, suitable for both beginners and experienced traders.

- Collaborates with BitGo - a leading digital asset security company to implement robust measures for safeguarding users' funds.

- Operates under international standards and holds licenses from major regulatory bodies in the U.S., Canada, and Singapore.

Cons:

- Restricted in certain countries.

- Supports a limited number of cryptocurrencies.

The third exchange on our list is Bybit, a platform specializing in derivative trading with high leverage. Recently, Bybit has expanded into spot trading, NFTs, and other crypto-related services.

Pros:

- Offers high-leverage derivative trading of up to 125x.

- Extremely competitive trading fees, capped at a maximum of 0.055% for contract trading and 0.1% for spot trading, with flexible fee adjustments based on the user’s VIP level.

- Delivers a dedicated insurance fund to protect traders from excessive losses in Derivatives trading.

Cons:

- Does not offer OTC (Over-the-Counter) trading.

- Allows direct deposits from banks but only supports a limited number of fiat currencies through intermediaries.

Choosing a secure and suitable cryptocurrency wallet is an important step to protect your digital assets. Depending on your needs, you can opt for a hot wallet for quick transactions or a cold wallet for long-term storage with enhanced security. Each type of wallet has its own unique features, so it is essential to consider factors such as security, cryptocurrency compatibility, and DeFi/NFT compatibility to select the right one for you. We hope this guide helps you make informed decisions and achieve success in your crypto investment journey.

Thank you for spending your time to read the entire article!

If you have any questions or inquiries, please contact us at TRADEGURUZ.