Over the past decade, the cryptocurrency market has grown at an unprecedented pace, attracting the attention of both individual investors and major financial institutions. However, concerns over regulatory hurdles, security risks, and extreme price volatility have made various investors hesitant to hold digital assets directly. Cryptocurrency ETFs were launched as a solution to allow easier access to the crypto market through professionally managed investment funds. Why is Cryptocurrency ETF considered a gateway to bring cryptocurrencies into the traditional financial flow? This article will delve into everything you need to know about a Crypto ETF, how they work, their advantages and drawbacks, and explore the most popular funds today.

A Crypto ETF (Cryptocurrency Exchange-Traded Fund) is an investment fund designed to track the price movements of one or multiple cryptocurrencies. These funds are traded on stock exchanges just like regular stocks. Instead of directly buying and holding cryptocurrencies, investors can invest in ETF shares, allowing them to profit from price movements without the complexities of managing or storing digital assets. Crypto ETFs are regulated by major financial authorities such as the U.S. Securities and Exchange Commission (SEC), ensuring a higher transparency than decentralized exchanges or even some centralized platforms. In 2024, the SEC approved Bitcoin and Ethereum ETFs, enabling investors to trade the two largest cryptocurrencies in the world.

Crypto ETFs are created and managed by fund providers, typically large investment and asset management firms. These institutions purchase underlying crypto assets and form a fund to hold them. Then, they issue the fund's shares that investors can trade on traditional stock markets, just like any other ETF. The key advantage of Crypto ETFs is that they allow investors to gain exposure to cryptocurrencies without buying them directly. This makes them an ideal solution for those interested in cryptocurrencies but hesitant to deal with private key management, asset security, or unclear regulatory frameworks. Instead of setting up crypto wallets and worrying about cyber threats, investors can buy Crypto ETF shares and leave asset management to professionals.

However, one crucial aspect that needs to be aware of is ownership. When you buy shares in a cryptocurrency ETF, you do not own the cryptocurrency but only hold a portion of the fund’s value. As a result, you cannot withdraw or transfer the underlying crypto assets to a personal wallet. Additionally, while ETF share prices generally reflect the value of the underlying crypto assets, they are not always identical. Since Crypto ETFs are traded on stock markets, their prices may be influenced by investor demand, fund management fees, and other factors, leading to slight discrepancies compared to the actual crypto market price.

Currently, there are two main types of Crypto ETFs: Spot Crypto ETFs and Futures Crypto ETFs. Each has its investment approach, offering unique benefits and risks.

A Spot Crypto ETF tracks the "spot" price of a cryptocurrency, meaning the real-time market price at which a digital asset is being traded. This type of fund directly purchases and holds actual cryptocurrencies. When investors buy the fund's shares, the fund uses that capital to acquire and securely store digital assets with reputable custodians. As a result, the value of a Spot ETF closely mirrors the price movements of the underlying crypto assets, eliminating the risk of price discrepancies between the crypto market and the stock market.

Nevertheless, since these funds must physically purchase and store cryptocurrencies, they are subject to strict regulatory requirements. Regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) had previously delayed approvals of Spot Bitcoin ETFs due to transparency and market manipulation concerns. Between October 2022 and October 2023 alone, the SEC received over 3,500 crypto-related ETF applications. It was not until 2024 that the SEC officially approved the first 11 Spot Bitcoin ETFs, paving the way for more spot-based cryptocurrency ETFs in the future.

Unlike Spot Crypto ETFs, Futures Crypto ETFs do not hold actual cryptocurrencies but invest in futures contracts. A futures contract is an agreement to buy or sell a cryptocurrency at a fixed price on a specified future date. These ETFs are typically traded on major derivatives exchanges and are subject to strict regulatory oversight, so they have received approval more easily than spot-based ETFs.

That being said, there are some key considerations for investors. If market sentiment is bullish, traders will buy more futures contracts, driving the futures price higher than the spot price - a phenomenon known as "contango." Conversely, if the market sentiment is bearish, the futures price may fall below the spot price, resulting in "backwardation." Because of these fluctuations, the price of a Futures ETF does not always move in parallel with the actual cryptocurrency price. Instead, it is influenced by futures market dynamics and investor speculation.

The cryptocurrency market is undeniably attractive, but entering the space can be complex for traditional investors. Buying crypto requires registering accounts on exchanges, managing crypto wallets, and learning how to secure digital assets. With Crypto ETFs, the process is not as complicated. Investors merely trade ETF shares on stock exchanges, just like they would with traditional stocks rather than navigating complicated trading platforms and securing private keys.

Keeping crypto in a personal wallet can give you a sense of absolute control, but it also comes with a host of risks. Losing your private key means losing access to funds permanently, and hackers can drain wallets within seconds. Even when using hardware wallets, investors still face risks like device malfunctions or forgetting recovery phrases. Crypto ETFs eliminate these security concerns by entrusting asset storage to major financial institutions. These funds employ institutional-grade security measures and strict custody protocols, ensuring that digital assets remain protected. Therefore, investors can gain exposure to crypto without worrying about theft, lost keys, or technical mishaps.

One of the main advantages of Crypto ETFs over direct crypto investments is the legal protection and oversight they receive from financial regulators. Licensed Crypto ETFs operate under approval processes enforced by major regulatory bodies such as the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the UK’s Financial Conduct Authority (FCA), and the European Securities and Markets Authority (ESMA). These organizations adhere to strict fund management rules, ensuring asset safety, transparent disclosures, and investor protection measures. As a result, investing in a Crypto ETF delivers not only exposure to the crypto market but also legal rights similar to those of traditional stock or mutual fund investors.

Portfolio diversification is one of the fundamental principles in investing. Instead of purchasing individual cryptocurrencies and bearing the risk of a single asset's price fluctuations, investors can invest in a basket of digital assets through an ETF. Some ETFs focus solely on Bitcoin or Ethereum, while others host diverse cryptocurrencies or even blockchain-related company stocks. For example, an Ethereum ETF might also hold Bitcoin or even shares of Meta. This approach enables investors to capitalize on the growth of the crypto market while distributing risk more efficiently, rather than putting all their capital into a single coin.

While ETFs offer convenience, they come with relatively high annual management fees. This is understandable, as these funds are operated by major financial institutions that both manage assets, ensure liquidity, and execute complex transactions. While these fees may appear minor in the short term, they can substantially reduce overall returns over time, particularly in a stagnant or declining market.

Although Crypto ETFs are traded on stock exchanges, their value remains tied to the crypto market, which is known for its extreme volatility. This makes them a higher-risk investment. Moreover, despite the rapid growth of the crypto industry, the market is still relatively young. It has a much smaller market capitalization than traditional financial markets, which increases its susceptibility to price manipulation. These concerns explain why the SEC repeatedly rejected Bitcoin Spot ETF applications for years before finally approving them in 2024.

One of the biggest drawbacks of Crypto ETFs is that investors do not directly own the underlying digital assets but they hold shares that represent these assets. This means ETF investors cannot transfer their crypto holdings to a private wallet, stake assets, or use them for direct blockchain transactions. If the ETF were to encounter issues or shut down, investors wouldn’t be able to claim their share of the fund’s cryptocurrency holdings, they could only sell their ETF shares on the stock exchange.

After exploring the benefits and challenges of Crypto ETFs, you probably have a clearer understanding of this investment channel. But with so many options available, choosing the right ETF can be overwhelming. If you are still unsure about which fund to choose, let's take a look at some of the most popular Crypto ETFs that every investor should know.

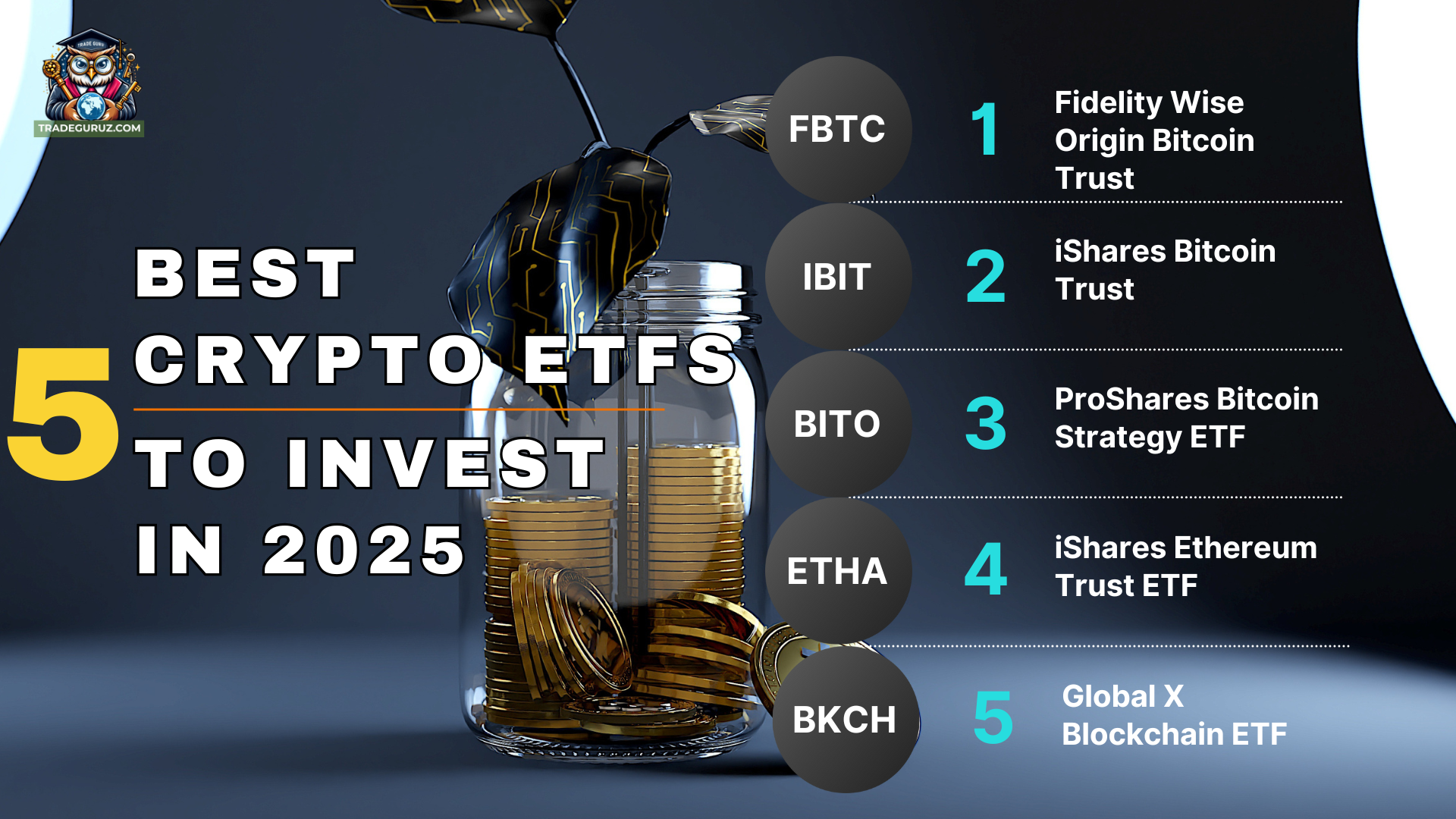

Fidelity Wise Origin Bitcoin Trust is one of the 11 Bitcoin ETFs launched in January 2024 after receiving SEC approval. This Spot Bitcoin ETF has gained significant investor interest due to the backing of Fidelity - one of the world’s leading asset management firms. The fund holds actual Bitcoin, providing a major advantage for investors who want direct exposure to Bitcoin’s price without self-custody. With professional and transparent management from Fidelity, FBTC is considered a safer choice than directly investing in crypto. This Bitcoin ETF has an expense ratio of 0.25%, meaning that for a $1,000 investment, the annual fee is $2.50.

IBIT is a flagship Bitcoin ETF from BlackRock, a fund management giant with trillions of dollars in assets under management. As one of the first Spot Bitcoin ETFs approved by the SEC, IBIT helped pave the way for institutional capital to flow into the crypto market. The fund quickly became one of the largest Bitcoin ETFs, accumulating over $50 billion in AUM in its first year. IBIT attracts investors due to BlackRock’s stability and reputation, reducing concerns about regulatory uncertainty and security risks. It is also an affordable option with a management fee of 0.25%.

Unlike FBTC and IBIT, ProShares Bitcoin Strategy ETF (BITO) does not directly hold Bitcoin. Instead, it invests in futures contracts, meaning its price is influenced by futures market trends rather than the actual spot price of Bitcoin. BITO remains one of the most actively traded Bitcoin ETFs, particularly attracting investors who prefer derivatives-based exposure over direct crypto ownership. Due to the nature of futures contracts, however, BITO may experience price discrepancies and additional costs, affecting long-term returns. The expense ratio for BITO is 0.95%, which is relatively high compared to the market average.

While Bitcoin ETFs are becoming mainstream, Ethereum ETFs are also gaining attention, with ETHA being one of the pioneers. Managed by BlackRock, ETHA delivers a safer gain exposure to Ethereum while avoiding risks related to asset storage. The launch of this fund marks an important step toward recognizing Ethereum as a traditional financial asset. The iShares Ethereum Trust ETF has an expense ratio of 0.25%, similar to comparable funds, but with a temporary discount. For the first 12 months starting July 23, 2024, the expense ratio is reduced to 0.12% for the first $2.5 billion AUM.

BKCH takes a different approach than focusing solely on crypto: investing in leading companies in the blockchain industry. This ETF includes stocks from major corporations such as Coinbase, Nvidia, and Bitcoin mining firms. This strategy allows investors to benefit from blockchain growth without direct exposure to crypto. It also reduces the risk of price volatility compared to funds that hold Bitcoin or Ethereum. It is slightly more expensive, with an expense ratio of 0.5%, but it is well-capitalized with $184 million in AUM.

>> You may be interested in Best Crypto to Buy Now: Discover the Top Picks for Smart Investors in 2025

Crypto ETFs have opened a new pathway for investors to enter the crypto market. By merging traditional finance with blockchain technology, these ETFs simplify the investment process and offer higher transparency under financial regulators’ oversight. However, high management fees, price volatility, and potential market manipulation remain factors to consider. Despite these challenges, the rise of crypto ETFs signals the growing acceptance of cryptocurrencies in traditional finance. With a well-planned investment strategy, Crypto ETF can be an attractive option for a long-term portfolio.

Thank you for taking the time to read this article.

For more information, please contact us at TRADEGURUZ.