The cryptocurrency industry is growing at an unprecedented pace with various cryptocurrencies. Among the prominent cryptocurrencies, Bitcoin and Ethereum are the most frequently mentioned names. This also leads to frequent comparisons between the two. In this article, we will explore the fundamental information about BTC and ETH, thereby finding their core distinctions. Additionally, it will examine recent ETH and BTC price USD fluctuations, offering a broader perspective on their market dynamics over the past six years.

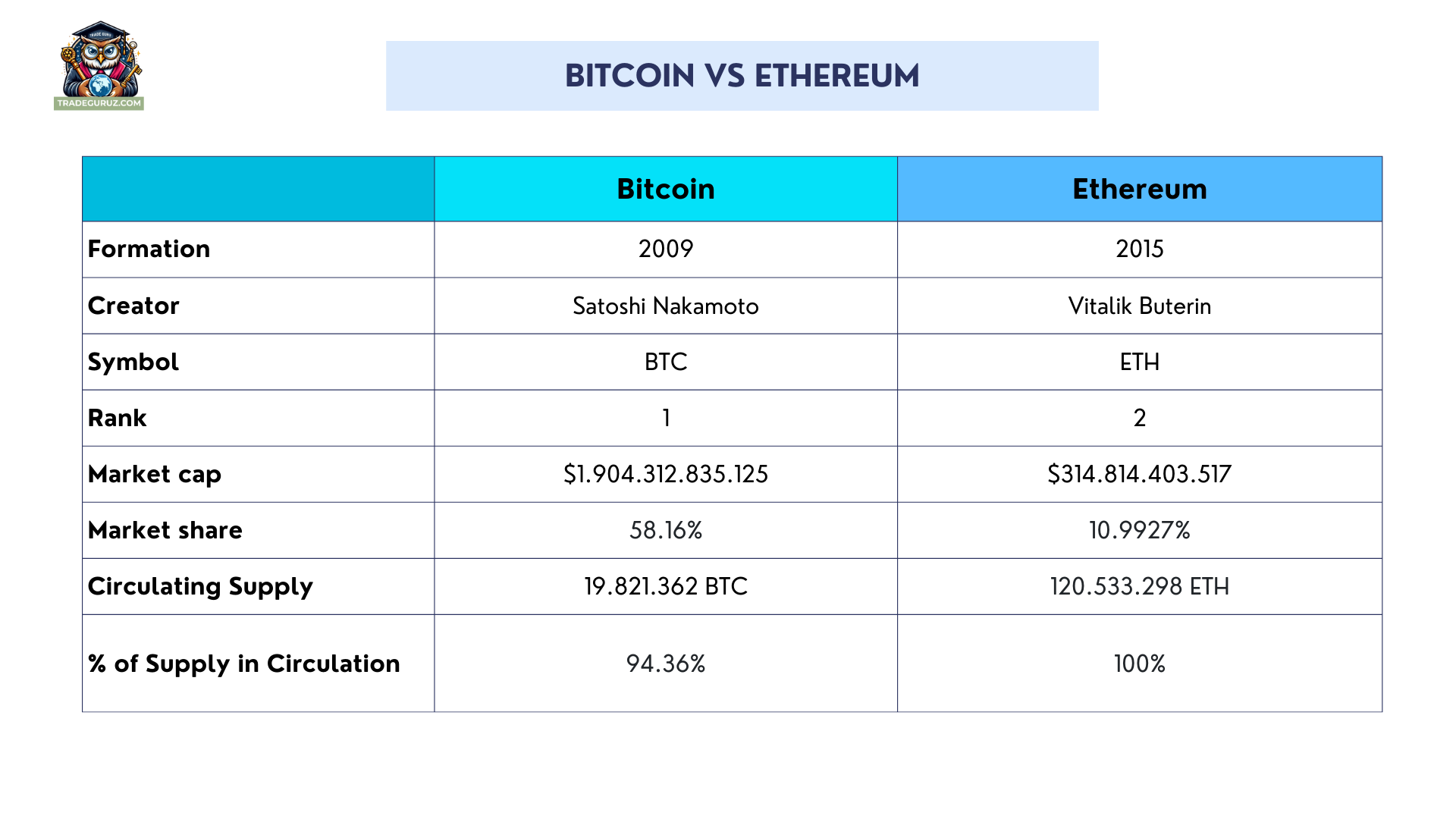

BTC is the symbol for Bitcoin, the world's most valuable cryptocurrency. It was the first cryptocurrency created in 2009 by an anonymous individual or group under Satoshi Nakamoto's pseudonym. Bitcoin has become a symbol of a decentralized financial system, operating independently of any financial institution or government. Today, BTC remains the leading cryptocurrency and the most actively traded asset on most major exchanges with a market capitalization of more than 1.9 trillion USD.

ETH is the native cryptocurrency of the Ethereum platform, an open-source blockchain launched in 2015 by Vitalik Buterin and his team. If Bitcoin is the leading coin in the cryptocurrency market, Ethereum is the next name expected to be able to dethrone Bitcoin. More than just a digital currency, Ethereum serves as a blockchain platform designed to facilitate decentralized applications (dApps) and smart contracts, making it a cornerstone of blockchain innovation.

While both Bitcoin and Ethereum operate on distributed ledger technology and cryptographic principles, they exhibit several fundamental differences.

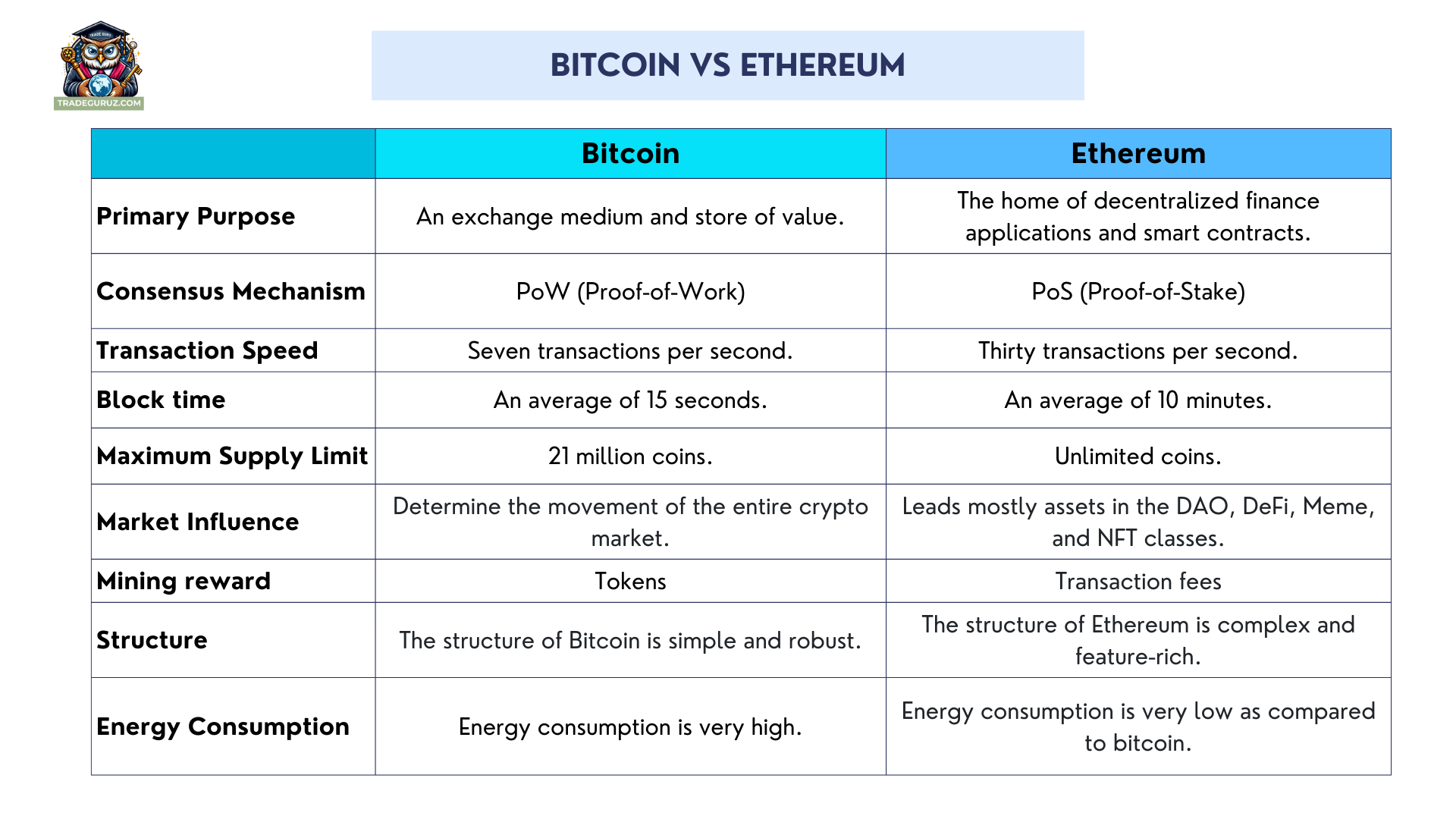

Bitcoin runs on a straightforward blockchain primarily designed for securely recording transactions. It does not support smart contracts but solely functions as a medium for value transfer. While Bitcoin’s blockchain structure is highly stable, it faces limitations in transaction processing speed.

In contrast, Ethereum is built as an open blockchain platform that supports smart contracts and decentralized applications (dApps). It utilizes the Ethereum Virtual Machine (EVM), enabling developers to create applications without a separate blockchain. This is the biggest difference from Bitcoin, making Ethereum the center of the decentralized finance (DeFi) ecosystem, NFTs, and other blockchain applications.

The consensus mechanism determines how transactions are validated and recorded on a blockchain.

Bitcoin employs the Proof-of-Work (PoW) mechanism, requiring miners to solve complex cryptographic puzzles to validate transactions. While this ensures a high level of security, it also demands substantial energy consumption, leading to environmental concerns.

Ethereum initially used PoW but transitioned to a Proof-of-Stake (PoS) model with the Ethereum 2.0 upgrade (The Merge) in 2022. PoS allows ETH holders to participate in transaction validation by staking a certain amount of ETH instead of relying on computational power like PoW. This shift has significantly reduced energy consumption, enhanced transaction speeds, and improved network scalability.

Although both Bitcoin and Ethereum are among the most valuable cryptocurrencies, their primary objectives differ.

Bitcoin is often regarded as "digital gold", serving as a store of value, an inflation hedge, and a peer-to-peer payment method. In contrast, Ethereum extends beyond being a cryptocurrency - it is a blockchain platform that facilitates smart contracts and decentralized applications. Ethereum provides the infrastructure to develop applications such as decentralized finance (DeFi), NFT, blockchain games, etc. Therefore, Ethereum has a broader role than Bitcoin, not only limited to financial transactions but also opening up various possibilities for applying blockchain technology in practice.

Transaction processing speed is a crucial factor when comparing these two cryptocurrencies.

Bitcoin takes about 10 minutes to create a new block and can handle around seven transactions per second. Its slow processing time can lead to network congestion during peak transaction times. Meanwhile, Ethereum offers significantly faster transaction speeds, with an average block time of about 15 seconds and a processing capacity of up to 30 transactions per second.

Bitcoin has a limited supply of 21 million BTC, creating scarcity that strengthens its long-term value as a store of wealth. It is expected that by 2140, all BTC will be mined, at which point miners will be rewarded with transaction fees instead of block rewards. Ethereum, however, does not have a fixed supply limit but has implemented a transaction fee-burning mechanism (EIP-1559). With each transaction, a base fee is permanently removed from circulation, helping to reduce inflation and enhance scarcity. Meanwhile, validators earn priority fees (tips) and staking rewards, ensuring network stability.

The cryptocurrency market gradually entered the recovery phase in 2019 after the downturn of 2018. Bitcoin maintained an average price range of $3,500–$7,200. However, the onset of the COVID-19 pandemic in early 2020 triggered a sharp decline, driving BTC to a low of $4,000 on March 17. Despite this, Bitcoin’s third Halving event in May 2020 played a crucial role in its price recovery. Additionally, major corporations and financial institutions such as MicroStrategy, Square, and Tesla started accumulating BTC as a hedge asset, fueling a significant rally. By the end of 2020, BTC had surpassed $20,000 and closed the year above $29,000.

During this period, Ethereum also showed signs of recovery but at a slower rate than BTC. ETH started 2020 at around $130 and experienced steady growth throughout the year, reaching approximately $737 by the end of December - marking an impressive surge within just 12 months.

2021 was a highly volatile year for BTC. Bitcoin saw a significant decline in value in the middle of the year, dropping to a yearly low of $29,970 on July 21, largely due to regulatory crackdowns, including China’s ban on cryptocurrency transactions. The latter part of the year brought a dramatic recovery. Bitcoin reached an all-time high of $69,000 in November, driven by increasing mainstream adoption, including Tesla’s decision to accept BTC payments.

Ethereum, on the other hand, witnessed a strong uptrend throughout the year and peaked at $4,800 in November thanks to the strong growth of NFTs on the Ethereum network, which attracted trillions of dollars in investment to the platform.

Following its peak in 2021, the cryptocurrency market entered a severe correction phase in 2022. BTC fell dramatically from $69,000 to $16,000 by the end of 2022. The main reasons included the tightening of monetary policy by the US Federal Reserve, rising inflation, and especially the collapse of the FTX exchange, which created a big shock that seriously shook investors’ confidence in the market.

ETH also could not avoid a serious decline when it bottomed out below $1,000 in June; however, ETH's scenario was somewhat more optimistic than Bitcoin's due to the network upgrade event switching from PoW to PoS - The Merge. While this shift helped Ethereum become more sustainable in the long term, it was not enough to stop ETH's decline under general market pressure in the short term.

Entering 2023-2024, the cryptocurrency market gradually recovered and regained investor confidence. BTC started 2023 at around $16,000 - $20,000 and quickly recovered to $30,000 - $45,000 by the end of the year thanks to positive news such as the SEC's approval of a spot Bitcoin ETF and the flow of capital from large organizations into the market. The year 2024 marked a strong resurgence for BTC. Following the fourth Bitcoin Halving event in April 2024, BTC surged to $70,000. By the end of the year, Bitcoin surpassed the $100,000 mark, significantly boosted by Donald Trump's re-election as U.S. president.

Ethereum followed a similar upward trajectory, starting 2023 at around $1,200–$1,500 before gradually climbing to $3,000–$4,000 by early 2024. This growth was supported by Ethereum’s continued role as the leading smart contract platform and the expansion of DeFi and NFT markets.

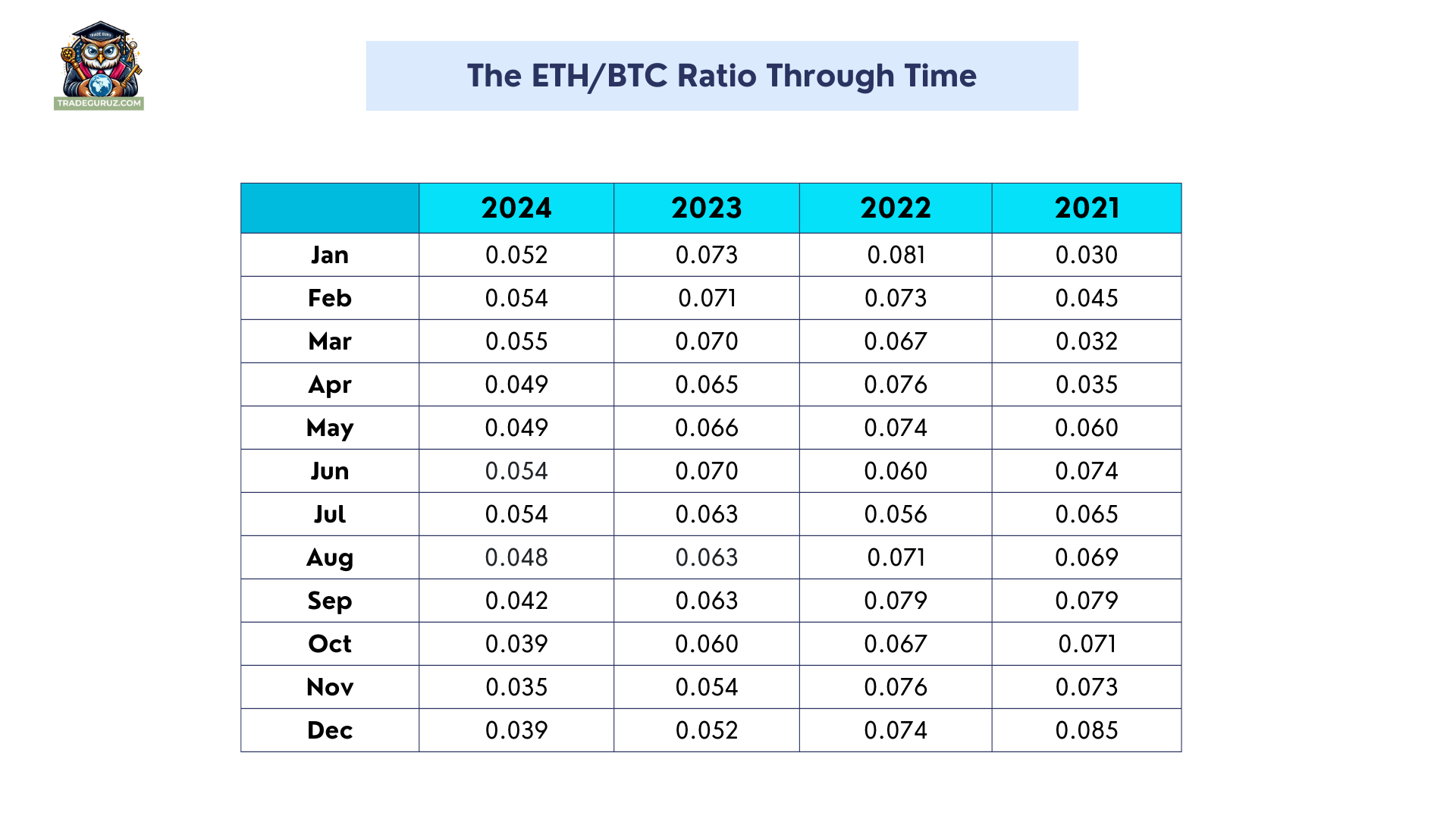

When discussing BTC and ETH, many investors solely focus on the prices of these two currencies and ignore the ETH/BTC ratio. In reality, this ratio is a crucial indicator for assessing the relative strength between Ethereum and Bitcoin. It serves as an indicator of market sentiment, guiding investment decisions by showing which of the two leading cryptocurrencies is currently favored.

A rising ETH/BTC ratio indicates market sentiment is relatively optimistic, with capital flowing towards higher-yield assets. Investors are willing to accept more risks and tend to shift capital from BTC to ETH and other altcoins. When this ratio goes in the opposite direction, Bitcoin shows superior strength, with market capitalization becoming heavily concentrated in BTC. During these periods, investors become more cautious and tend to withdraw capital from altcoins and return to safer assets such as BTC or stablecoins.

Choosing an investment asset is not merely about determining which one is superior but also depends on investment objectives, risk tolerance, and market trends. Bitcoin is considered a more defensive asset, often referred to as "digital gold" due to its limited supply and primary use as a store of value. If you are looking for a safer investment with lower risk, BTC may be the ideal choice.

On the other hand, Ethereum offers greater growth potential thanks to its extensive ecosystem, including DeFi, NFTs, Layer 2 solutions, and decentralized applications. ETH may become an attractive option for those willing to accept higher risk in exchange for potentially greater returns. That said, the decision to invest in BTC or ETH ultimately depends on individual goals and an understanding of the underlying technology of each cryptocurrency. Conduct thorough research to make informed decisions in this volatile financial world.

Bitcoin and Ethereum remain the top choices for investors, each presenting unique opportunities and challenges. ETH, BTC price USD, and other crypto prices are volatile by the hour. Before making an investment decision, make sure you have carefully assessed your investment goals, risk tolerance, and market factors. In particular, choosing a reputable exchange and keeping up to date with market information is important to protect your investment. Equip yourself with solid knowledge and build a clear strategy to maximize profits and minimize risks in this volatile market.

Thank you for taking the time to read the entire post.

For more detailed information, please contact us at TRADEGURUZ.